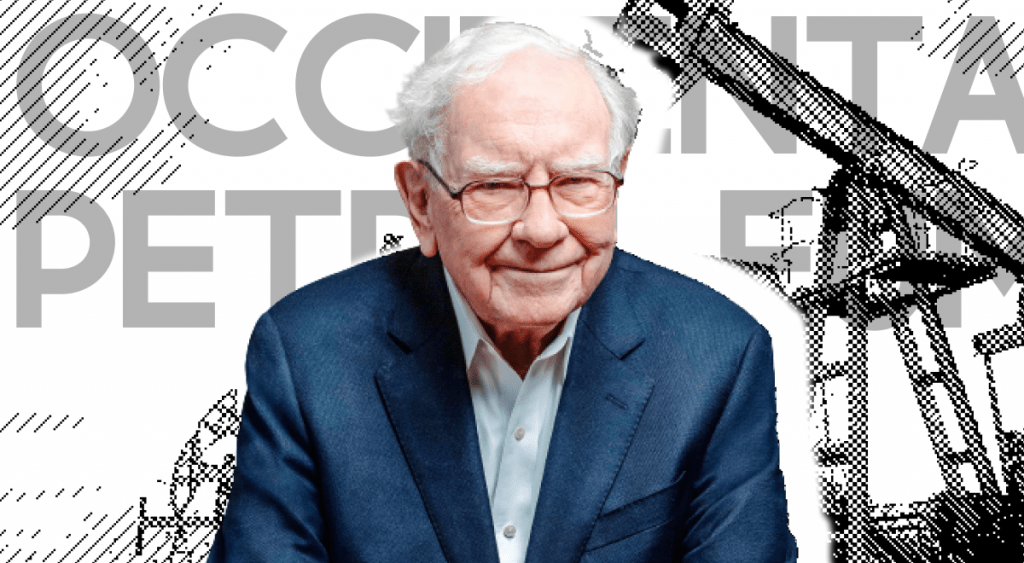

we’ll explore one of Warren Buffett’s most interesting moves: his recent investment in Occidental Petroleum (OXY). Buffett’s involvement has brought significant attention to the stock, making it a key player to watch for value investors. We’ll break down Occidental’s appeal using four straightforward steps: its recent news, fundamental strengths, financial metrics, and valuation. If you’re curious about why Buffett might see promise in this energy stock, read on to find out!

1. What’s in the News?

Let’s start with the headlines. Warren Buffett’s company, Berkshire Hathaway, recently bought a significant stake in Occidental Petroleum. He now holds about 28% of the company, with his investment valued at around $13 billion. While Occidental itself hasn’t made many recent waves in the media, Buffett’s interest in the company speaks volumes. Given that Buffett typically invests in companies with strong long-term potential and solid fundamentals, it’s worth exploring what he might see in Occidental.

2. Fundamentals of Occidental Petroleum

Occidental Petroleum is a key player in the energy sector, involved in the exploration and production of oil and natural gas. The company operates across multiple segments, including oil and gas, and chemicals making it a relatively diversified energy enterprise.

Given that energy demand remains high, the oil and gas sector is integral to the global economy. Occidental’s strategic acquisition of Anadarko Petroleum Corporation in 2020 significantly boosted its reserves and growth potential, although it also brought about challenges that impacted its financials in the short term. This acquisition gave Occidental access to valuable oil and gas reserves in Texas and New Mexico, setting the company up for long-term growth.

We use six indicators to check whether a company’s fundamentals are solid and healthy.

| Item (Avg. 5 years) | Value | Check mark |

| Revenue growth | 17.17% | ✅ |

| Net income growth | 420% | ✅ |

| Free cash flow growth | 4.38% | ✅ |

| Share buy back | -5.27% | ❌ |

| Long-term debt/fcf | 5.77 | ✅ |

| Dividend growth | 13.77% | ✅ |

3. Important ratios

If we take a look at the important ratios, there are a few metrics that stand out. The selling and general expense ratio is low at around 4% in 2024. We generally consider companies with < 20% selling and general expense ratio to have great competitive advantage as they do not need a lot of marketing to sell their products. Furthermore, we find a relatively stable gross profit margin with an average of 28%. Other than that we do not find any other remarkable ratios.

4. Valuation

When valuing a company we decided on the following inputs:

| Item | Input |

| Projection period | 15 years |

| Discount rate | 10% |

| Estimated growth rate | 6% |

| Projected P/E ratio | 14 |

| Required rate of return | 10% |

| Margin of safety | 30% |

1. Projection Period

- Reasoning: The chosen projection period is 15 years. This extended timeframe aligns with Buffett’s long-term approach to investing. As energy demand is projected to remain robust for the foreseeable future, a 15-year period allows for capturing the full impact of Occidental’s strategic acquisitions (like Anadarko) and long-term growth, despite the inherent volatility of the oil and gas sector. This length allows investors to benefit from compounding and the potential stabilization of oil prices over time.

2. Discount Rate

- Reasoning: The discount rate reflects the risk premium associated with investing in Occidental within the energy sector. Typically, the discount rate here might range from 8% to 10%, reflecting moderate-to-high volatility and sector risks but still considering Occidental’s established position in oil and gas. Given Buffett’s risk tolerance and confidence in Occidental, this rate accounts for sector volatility while providing a conservative return benchmark that acknowledges the company’s strategic relevance in the energy market.

3. Estimated Growth Rate

- Reasoning: A 6% annual growth rate is estimated for Occidental, based on its recent performance and strategic positioning post-Anadarko acquisition. This growth rate is conservative but realistic for a large-cap energy company, especially given fluctuating oil prices and the shift toward renewable energy. It reflects Occidental’s ability to sustain moderate growth over time, supported by stable demand for fossil fuels and its expanding resource base in U.S. oil regions.

Based on the transcript, here’s the rationale behind each input:

1. Projection Period

- Reasoning: The chosen projection period is 15 years. This extended timeframe aligns with Buffett’s long-term approach to investing. As energy demand is projected to remain robust for the foreseeable future, a 15-year period allows for capturing the full impact of Occidental’s strategic acquisitions (like Anadarko) and long-term growth, despite the inherent volatility of the oil and gas sector. This length allows investors to benefit from compounding and the potential stabilization of oil prices over time.

2. Discount Rate

- Reasoning: The discount rate reflects the risk premium associated with investing in Occidental within the energy sector. Typically, the discount rate here might range from 8% to 10%, reflecting moderate-to-high volatility and sector risks but still considering Occidental’s established position in oil and gas. Given Buffett’s risk tolerance and confidence in Occidental, this rate accounts for sector volatility while providing a conservative return benchmark that acknowledges the company’s strategic relevance in the energy market.

3. Estimated Growth Rate

- Reasoning: A 6% annual growth rate is estimated for Occidental, based on its recent performance and strategic positioning post-Anadarko acquisition. This growth rate is conservative but realistic for a large-cap energy company, especially given fluctuating oil prices and the shift toward renewable energy. It reflects Occidental’s ability to sustain moderate growth over time, supported by stable demand for fossil fuels and its expanding resource base in U.S. oil regions.

4. Projected P/E Ratio

- Reasoning: The projected P/E ratio is likely to be modest, around 12-15x. This valuation metric considers the company’s average historical P/E while accounting for the cyclical nature of the energy industry. A lower P/E is chosen as a conservative measure, factoring in possible declines in oil prices and market sensitivity. This ratio reflects that energy companies are valued at a lower multiple than high-growth sectors like technology, yet it remains attractive for a stable, dividend-paying stock with Buffett’s backing.

5. Required Rate of Return

- Reasoning: The required rate of return is likely around 8-10%, which aligns with the discount rate and is close to the returns of the S&P 500. This figure reflects a balance between Occidental’s moderate dividend yield and the growth expectations in the energy sector. This target rate is conservative yet achievable, considering the company’s capacity for debt repayment, steady cash flow, and strategic growth. It also meets Buffett’s typical requirement for investments that generate returns above inflation and other asset classes.

6. Margin of Safety

- Reasoning: A 30% margin of safety is sensible, acknowledging the volatility of the energy sector and Occidental’s exposure to commodity price fluctuations. This safety margin protects against potential valuation swings due to external factors, such as regulatory changes or shifts in energy prices, while still considering Occidental’s solid position. This buffer provides room for potential short-term setbacks while aligning with value investing principles, making Occidental a safer long-term hold if market conditions shift.

Results

Our calculations suggest that fair value lies around $44.87, adjusted for the margin of safety the buy in price would be around $31.41. The fair value is slightly higher than the current price which lies around $51.05. However, if we would remove one of the outliers, the fair value is suggested to be somewhere around $53,25 (not accounting for margin of safety).

Conclusion

Depending on your risk tolerance, OXY might be at a good price to pick-up. However, make sure to do your own due diligence.