Category: Valuations

-

Visa Inc. Fundamental Analysis amidst DOJ investigation

Visa Inc. is a giant in the payment processing world, handling over 60% of U.S. debit transactions and generating billions in revenue through data processing and merchant services. But is Visa stock worth adding to your portfolio today? In this post, we’ll walk through our four-step valuation process to determine if Visa is a good…

-

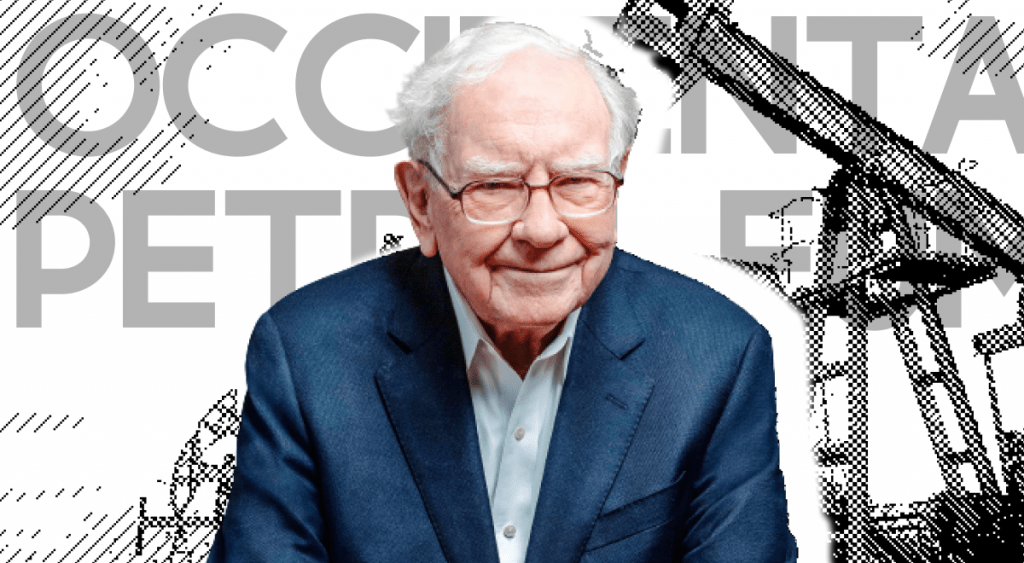

Warren Buffett’s Big Bet on Occidental Petroleum

we’ll explore one of Warren Buffett’s most interesting moves: his recent investment in Occidental Petroleum (OXY). Buffett’s involvement has brought significant attention to the stock, making it a key player to watch for value investors. We’ll break down Occidental’s appeal using four straightforward steps: its recent news, fundamental strengths, financial metrics, and valuation. If you’re…

-

Understanding Alibaba: Recent Developments and Investment Insights

Welcome to our in-depth analysis of Alibaba Group (NYSE: BABA), where we’ll explore recent market movements, financial fundamentals, and potential investment opportunities. With the Chinese economy undergoing significant changes, particularly after the recent stimulus measures introduced by the Central Bank, now is an ideal time to reassess Alibaba’s position in the market. Recent Market Developments…

-

Adobe Stock Analysis: Will They Ever Recover?

Whether you’re a seasoned investor or just starting out, Adobe is a company that often stands out due to its strong market presence and innovative solutions. In this post, we’ll break down Adobe’s key financial metrics, business model, and valuation methods to help you determine whether Adobe is a worthwhile addition to your investment portfolio.…

-

The Ultimate McDonald’s Stock Analysis: Is It Worth the Investment?

Whether you’re a seasoned investor or new to the market, McDonald’s is a popular stock that often catches the eye due to its robust fundamentals and iconic global presence. In this post, we’ll analyze the company’s key financial metrics, business model, and valuation methods to help you decide if McDonald’s is a worthy investment for…

-

Starbucks Stock: A Closer Look Under Its New CEO

In this post, we’re diving into a hot topic that’s been making headlines: Starbucks stock and why some analysts think it could more than double under its new CEO. Let’s break down the details and reevaluate the situation now that some time has passed since the initial buzz. The Big News: Starbucks’ New CEO A…

-

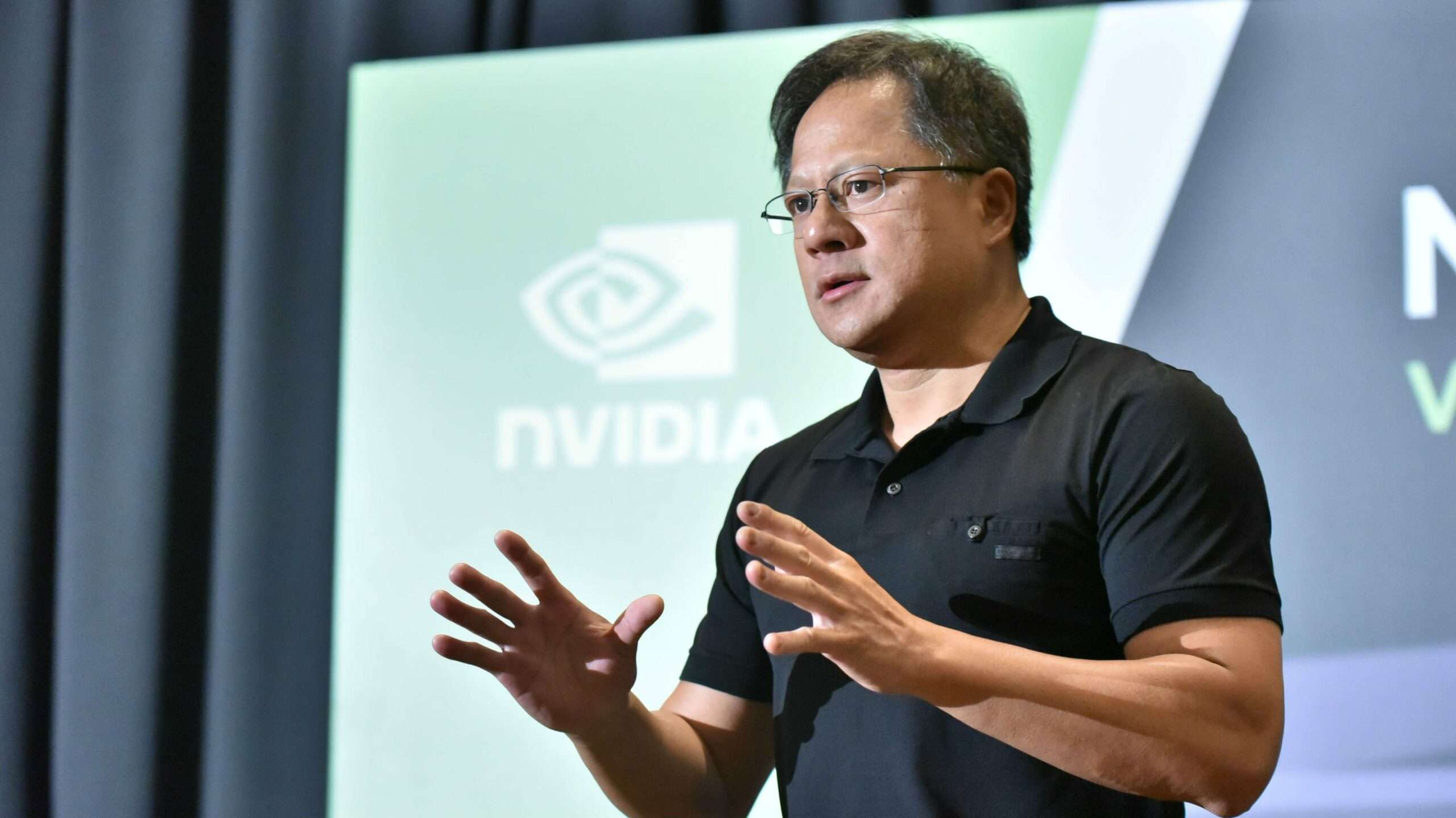

Nvidia Stock Plummets 8% Despite Strong Growth – Is It Overvalued? Here’s What Investors Need to Know!

Nvidia has been making headlines recently due to its business growth and stock performance. Although the company has demonstrated robust growth, its stock price has been a topic of debate among investors. In this article, we’ll break down Nvidia’s financial performance, market valuation, and potential future prospects to determine if its stock is truly overvalued.…

-

Why Warren Buffett Is Selling Apple: A Deep Dive into Berkshire Hathaway’s Investment Strategy

When Warren Buffett, one of the most revered investors of our time, makes a significant move in the stock market, the world takes notice. Recently, Buffett’s decision to sell a large portion of Berkshire Hathaway’s Apple holdings has sparked curiosity and debate among investors and financial analysts. In this blog post, we’ll explore the reasons…