Tag: Investment Strategies

-

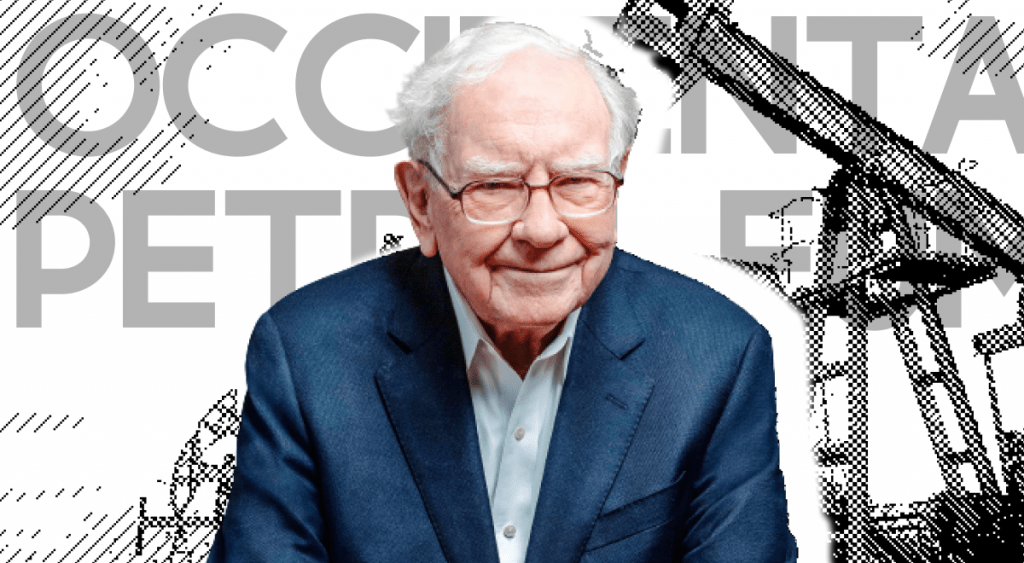

Warren Buffett’s Big Bet on Occidental Petroleum

we’ll explore one of Warren Buffett’s most interesting moves: his recent investment in Occidental Petroleum (OXY). Buffett’s involvement has brought significant attention to the stock, making it a key player to watch for value investors. We’ll break down Occidental’s appeal using four straightforward steps: its recent news, fundamental strengths, financial metrics, and valuation. If you’re…

-

Understanding Alibaba: Recent Developments and Investment Insights

Welcome to our in-depth analysis of Alibaba Group (NYSE: BABA), where we’ll explore recent market movements, financial fundamentals, and potential investment opportunities. With the Chinese economy undergoing significant changes, particularly after the recent stimulus measures introduced by the Central Bank, now is an ideal time to reassess Alibaba’s position in the market. Recent Market Developments…

-

The Ultimate McDonald’s Stock Analysis: Is It Worth the Investment?

Whether you’re a seasoned investor or new to the market, McDonald’s is a popular stock that often catches the eye due to its robust fundamentals and iconic global presence. In this post, we’ll analyze the company’s key financial metrics, business model, and valuation methods to help you decide if McDonald’s is a worthy investment for…